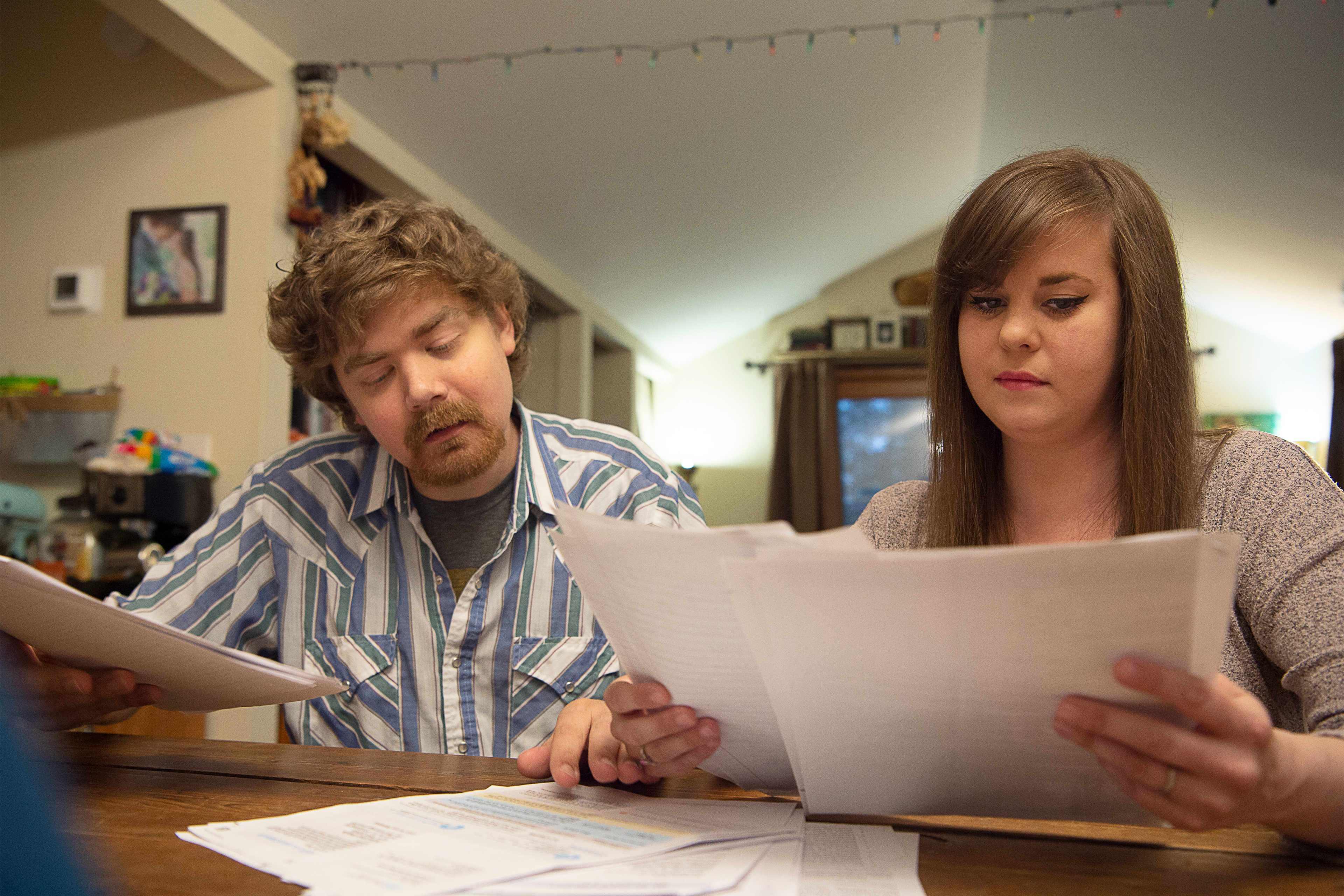

Sean Deines and his wife, Rebekah, have been road-tripping just after he lost his task as a bartender when the pandemic hit. But when browsing his grandfather in a distant portion of Wyoming, Sean began to truly feel incredibly ill.

Rebekah insisted he go to an urgent care center in Laramie.

“‘Your white blood count is as a result of the roof. You need to get to an ER suitable now,’” Deines, 32, recollects a staffer indicating. The North Carolina couple in the beginning drove to a healthcare facility in Casper but were speedily airlifted to the University of Colorado Hospital in the vicinity of Denver, in which he was admitted on Nov. 28, 2020.

There, specialists confirmed his prognosis: acute lymphoblastic leukemia, a rapidly-expanding blood most cancers.

“Literally inside of 12 hours, I necessary to figure out what to do with the following action of my life,” stated Deines.

So, following he was commenced on intravenous solutions, including steroids and antibiotics, in Colorado to stabilize him, the pair determined it was prudent to return to North Carolina, in which they could get help from his mother and mother-in-regulation. They chosen Duke University Medical Heart in Durham, which was in his insurance plan community.

His relatives called Angel MedFlight, section of Aviation West Charters of Scottsdale, Arizona, which instructed Rebekah Deines that it would acknowledge regardless of what the couple’s insurer would pay out and that they would not be held responsible for any remaining harmony.

Sean Deines was flown to North Carolina on Dec. 1, 2020, and taken by floor ambulance to Duke, where he expended the following 28 days as an inpatient.

By his discharge, he felt much better and items ended up seeking up.

Then the expenditures came.

The Affected individual: Sean Deines, 32, who bought protection as a result of the Affordable Care Act market with Blue Cross Blue Protect of North Carolina.

Health-related Company: A 1,468-mile air ambulance flight from Colorado to North Carolina, along with floor transportation among the hospitals and airports.

Services Provider: Aviation West Charters, carrying out enterprise as Angel MedFlight, a health-related transport business.

Total Invoice: $489,000, most of which was for the flight from Denver, with roughly $70,000 for the ground ambulance assistance to and from the Denver and Raleigh-Durham airports.

What Provides: Insurers generally get to come to a decision what care is “medically necessary” and thus protected. And that is generally in the eye of the beholder. In this case, the debate revolved initial all over irrespective of whether Deines was stable more than enough to properly get a three-plus-hour commercial flight to North Carolina in the course of a pandemic or essential the intensive care the air ambulance provided. 2nd, there was the problem of no matter whether Deines really should have stayed in Denver for his 28-day cure to get him into remission. Insurers have a tendency not to take into account client stress or family usefulness in their selections.

Also, both equally air and ground ambulance providers have been heart stage in the nationwide fight more than substantial surprise expenses, considering the fact that the for-profit providers that operate them often do not take part in insurance policies networks.

Angel MedFlight, which was not in Deines’ insurance plan community, sought prior authorization from Blue Cross Blue Protect of North Carolina. The request was dated Nov. 30, but the insurance provider reported the fax arrived in the predawn hours the similar working day as the flight, Dec. 1, 2020.

On that working day, Angel MedFlight flew Deines to North Carolina in an plane, together with a nurse to oversee his IV medications and oxygen stages.

Angel MedFlight spokesperson Kimberly Halloran did not remedy a unique penned query from KHN about why the flight went forward without the need of prior approval often medical interventions are postponed until eventually it has been acquired. But in an emailed statement, she said the business “satisfied each action in the well being insurance coverage approach and transported Sean to his very long-expression wellness care suppliers in very good religion.”

In accordance to the evaluation of the circumstance completed months later on by an unbiased evaluator, Blue Cross on Dec. 3 denied protection for the air ambulance expert services for the reason that medical records did not help that it was an emergency and Deines was previously in an acceptable medical facility.

At the close of December, an attractiveness was submitted versus that determination on behalf of Deines by Angel MedFlight.

Then, in March 2021, Blue Cross sent Deines a examine for $72,000 to cover aspect of the $489,000 invoice, which he forwarded to the air ambulance firm. The rationalization of benefits showed the the greater part of the rates have been ruled “not medically important.”

Angel MedFlight, via a revenue administration company it hires identified as MedHealth Partners, continued to charm to Blue Cross to overturn the denial of the flight part of the invoice.

Then, three months just after Blue Cross despatched the verify that Deines then despatched on to Angel MedFlight, the insurer demanded Deines pay back back the $72,000.

“The initial considered was ‘I simply cannot think this is going on,’” said Deines.

Healthcare necessity standards are established by insurers, with North Carolina Blue Cross covering air ambulances in “exceptional situations,” this kind of as when wanted cure isn’t obtainable locally.

When Deines, who was nonetheless unemployed and going through treatment, couldn’t spend, the debt was despatched to collections.

In late June, Deines’ associates at Angel MedFlight took the next phase authorized less than the Very affordable Treatment Act, pleasing the insurer’s inside perseverance that the flight was not medically essential to an unbiased 3rd bash by way of the point out.

On July 29, the evaluator dominated in favor of Blue Cross.

Commonly, such a flight would be appropriate because the affected person was “medically unfit to vacation through industrial airflight,” the assessment noted. But, it went on to say, there was really no need to have to vacation, as the University of Colorado Medical center — a member of the Countrywide Complete Most cancers Network — could have managed Deines’ cure.

His wellness approach “clearly stipulates their indications for health care flight protection and, sad to say, this case does not meet that requirements,” the critique concluded.

Resolution: The monthly bill disappeared only following the push obtained associated. Shortly just after a KHN reporter contacted the communications representatives for the two the insurance provider and Angel MedFlight, Deines read from the two of them.

The $72,000 payment was made in error, claimed Blue Cross spokesperson Jami Sowers.

“We apologize for putting the member in the center of this complex problem,” she stated in an electronic mail that also observed “the air ambulance company billed more than $70,000 just for floor transportation to and from the airport — far more than 30 times the common expense of medical floor transportation.”

These types of a situation would “typically” be flagged by inner programs but for some rationale was not, Sowers claimed.

“I have in no way listened to of a floor transportation that prices that a great deal. That’s stunning,” mentioned Erin Fuse Brown, director of the Heart for Regulation, Wellness & Modern society at Georgia Condition College Higher education of Legislation, who scientific studies client billing and air ambulance costs.

Even now, there’s good information for Deines: Both of those the insurer and the air ambulance business explained to KHN he will not be held liable for any of the charges. (None of the costs stemmed from his first air ambulance flight from Casper to Denver, which was coated by the insurance provider.)

“Once North Carolina Blue engages in our formal inquiries about its refund ask for, the position of the cash will be settled,” the ambulance spokesperson wrote in her e-mail. “One point is particular, Sean will not have to shell out for North Carolina’s wavering coverage conclusion.”

In an email, Sowers said Blue Cross experienced “ceased all recoupment efforts” similar to Sean’s case.

The Takeaway: If the flight had transpired this 12 months, the pair might have received a lot more price information and facts prior to they took the flight.

A regulation termed the No Surprises Act took result Jan. 1. Its principal thrust is to protect insured individuals from “balance bills” for the change involving what their coverage pays and what an out-of-community provider charges in emergencies.

It also handles nonemergency cases in which an insured affected individual is taken care of in an in-community facility by an out-of-community service provider. In these situations, the client would pay only what they would owe had the service been absolutely in-community.

Another component of the legislation, called a fantastic religion estimate, could have delivered Deines with additional transparency into the expenditures.

That portion states health care companies, which includes air ambulances, should give upfront expense estimates in nonemergency circumstances to sufferers. Had the regulation been in outcome, Deines may well have figured out prior to the flight that it could be billed at $489,000.

Insured clients in very similar circumstances these days should really usually test initial with their insurer, if they are ready, to see if an air transport would be protected, specialists said.

Even if the legislation experienced been in impact, it most likely would not have aided with the major dangle-up in Deines’ situation: the disagreement over “medical necessity.” Insurers nevertheless have leeway to outline it.

For his part, Deines stated he’s happy he took the flight to be nearer to residence and family, in spite of the later on monetary shock.

“I would not adjust it, simply because it supplied guidance for myself and my spouse, who needed to get treatment of me she was retaining my sanity,” he reported.

Stephanie O’Neill contributed the audio portrait with this tale.

Monthly bill of the Month is a crowdsourced investigation by KHN and NPR that dissects and explains health-related costs. Do you have an attention-grabbing professional medical invoice you want to share with us? Inform us about it!